Tightwads and Spendthrifts - Scott Rick - Review

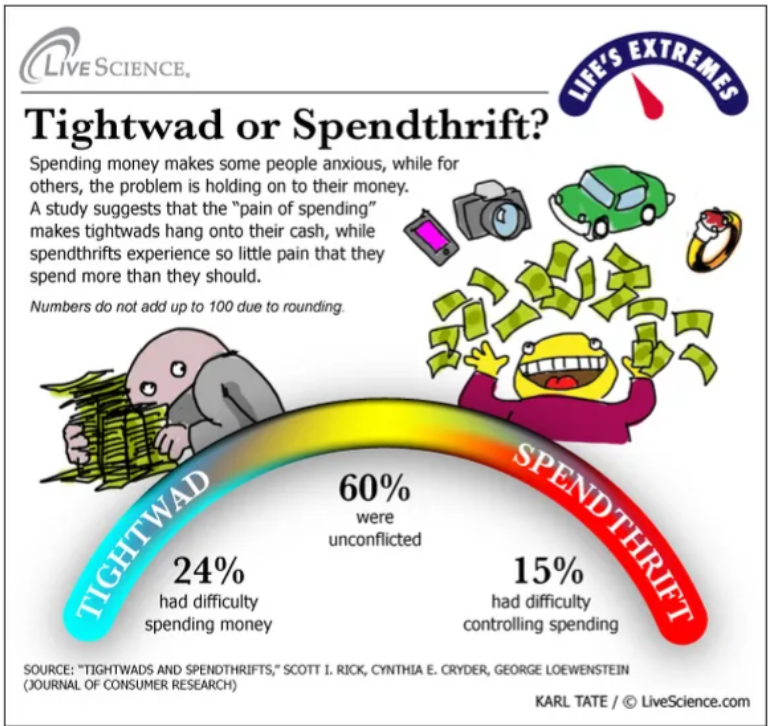

A tightwad is someone, largely gender neutral, who refrains from spending on essential products or services wherein he or she should have while a spendthrifts opens up their purse on unnecessary items pushing themselves well beyond what was needed. In short, tightwads experience pain in spending while spendthrift are carefree to a point of even going bankrupt. The expenses in consideration includes the entire spectrum ranging from food, clothes, housing, education and entertainment as well. As per research, the combination of tightwad and spendthrift forms 40% of the spending diaspora while the remaining 60% fall in an unconflicted zone of being at a relative balance in their expense factor.

For a start, such an analysis is extremely hard to conduct since a meaningful conclusion can only be unearthed after considering a wide sample covering different geographies and observed over a long longitude dimension cutting across decades. Scott's reasoning is based out of secondary research and certainly doesn't have the longitudinal requirements for a solid conclusion. However, based on research from limited sample sizes, it's indications offer interesting glimpses on the complex interplay of money and it's influence on nuptial relationships.

Scott touches upon aspects that alleviates the pain of spending amongst tightwad or even with people belonging to unconflicted zone. Casino typically use chips or alternate forms of cash that gives the participants an inclination to view it as a game and considerably reduce the sensitivity towards expense over casino games especially gambling. On a quick reflection, the methods adopted by the house does work for them in opening up the purse, there are a range of other tactics deployed as well, which can be parked for a later discussion.

On the flip side, Bank of America's Merrill Edge created face retirement app which displayed age processed image of customers which encouraged them to save more for their future. It's a positive tactic to make their prospects and customers realize that age will eventually catch up thereby reducing their cognitive and functional ability to earn.

A large part of Scott's book has been around decisive interplay of desires, needs and money in the backdrop of tightwad and spendthrift couple. Does it play as an equalizer bringing the expense in balance or frustrate both of them on being incompatible in their disposition, there are no clear answers and it's purely contextual.Finally, Scott has also touched upon influence of spendthrift on their children, the last any parent wants is their wards also following suit. But the pattern exhibited is 'do as they do, not as they say', in essense kids act as their parents do on aspects related to money and don't align when parents preach best practices which they themselves don't follow.

Overall, I liked the construct set up by the author to determine a meaningful conclusion but the book can be passed on for better alternatives.

Comments